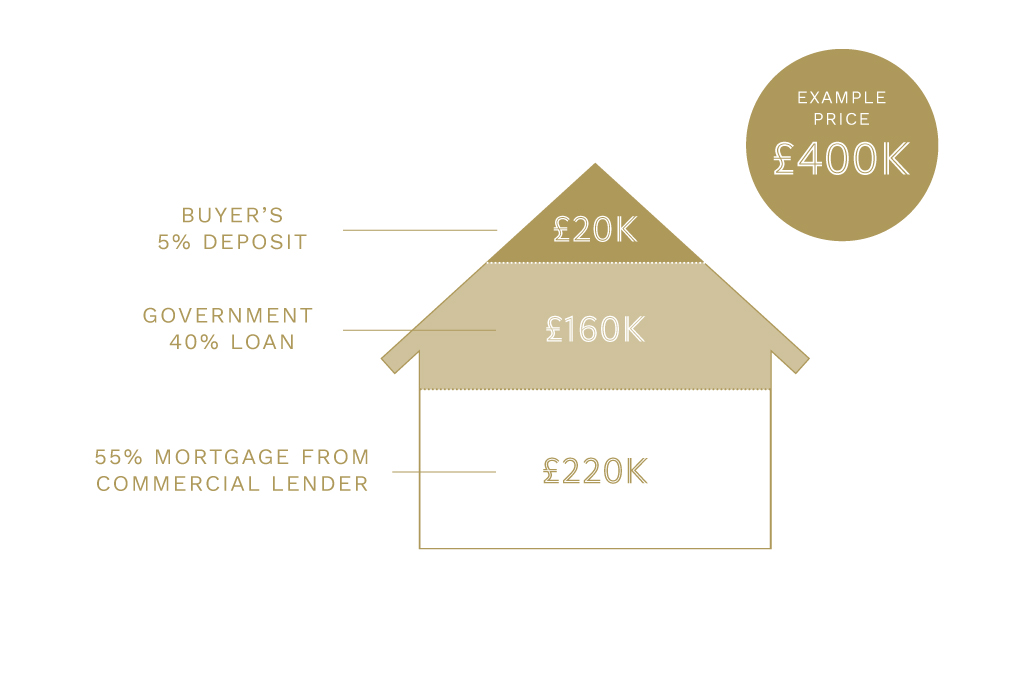

Owning your own home in the capital city can be made possible with the help of the Government backed London Help to Buy scheme. Designed to reflect the current property prices in London, when you put down as little as a 5% deposit on a newly built home, you can get a government equity loan of up to 40% of the purchase price. What’s better, is when you purchase a property through London Help to Buy, you won’t be charged loan fees for the first 5 years of owning your dream home in the capital city.

London Help to Buy

What is the London Help to Buy: Equity Loan scheme?

Am I eligible for the Equity Loan?

Whether you’re a first-time buyer or second-stepper, you are eligible for the Equity Loan! However, the scheme is only available for properties worth up to £600,000.

Things that may affect your eligibility:

- If you plan to sublet the home or enter a part exchange deal

- If you own another property at the time you take out an Equity Loan for another property.

If you want to find out more about applying for Help to Buy: Equity Loan for Solis Mews, we’ll be happy to answer questions where we can, and provide any information on our properties.